It is time for the RxTrace look at the estimated rise in the percentage of drugs in the U.S. supply chain that are serialized. Every year we take a look at this topic while longingly wishing that someone would perform a real study and publish the numbers. However, it may not make much difference from here on out because it will be impossible for drugs without serial numbers to exist in the U.S. supply chain in just a few years. So let’s take a look.

It is time for the RxTrace look at the estimated rise in the percentage of drugs in the U.S. supply chain that are serialized. Every year we take a look at this topic while longingly wishing that someone would perform a real study and publish the numbers. However, it may not make much difference from here on out because it will be impossible for drugs without serial numbers to exist in the U.S. supply chain in just a few years. So let’s take a look.

At the beginning of August, I have published my personal prediction of the rise in drug serialization since 2010. See “Estimated Rise In Serialized Drugs In The U.S. Supply Chain” for the full explanation and background of this estimate. The other essays in this series are:

- “Estimated Rise in Serialized Drugs in The U.S. Supply Chain, 2011“;

- “InBrief: Estimated Rise in Serialized Drugs in The U.S. Supply Chain, 2012“;

- “InBrief: Estimated Rise in Serialized Drugs in The U.S. Supply Chain, 2013“.

Those earlier predictions were based on the effective dates of the California pedigree law, which would have required manufacturers to place unique serial numbers on all of their drug packages that were distributed into that state by January 2016 (with 50% of them serialized by January 2015). Last November, Congress passed, and President Obama signed the Drug Quality and Security Act (DQSA) (HR 3204), part of which is the Drug Supply Chain Security Act (DSCSA), which contains preemption language that makes the old California law ineffective and obsolete. The same is true of all other drug pedigree laws in the U.S.

The new federal law requires serialization of all drugs entering the U.S. drug supply chain after November 27, 2017. That’s the new target date for manufacturers, but since any drugs that were already present in the supply chain on that date will not need to be serialized, we probably won’t see 100% serialization within the supply chain until a few years after that date.

This actually makes my prediction a lot easier, because the DSCSA applies to then entire United States and I am confident that wholesale distributors of all sizes will effectively enforce the serialization part of the law. That is, they will not want the risk of being charged with the possession of non-serialized drugs that are not grandfathered, and so they will not buy non-serialized drugs from manufacturers after their effective date in 2019 (see “DSCSA: Special Privileges For The “Big-3″ Wholesale Distributors, Part 2“). That should be a huge incentive to manufacturers. Don’t be late with your serialization program or you will likely be out-of-business on that date in the world’s largest pharmaceutical market.

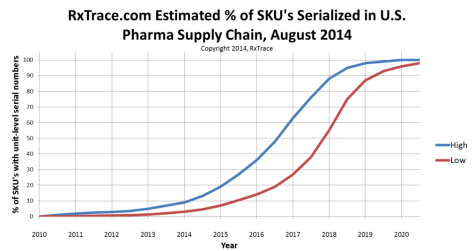

So here is my newly updated graph containing my current prediction. In the absence of any hard data on the current percentage of drugs containing serial numbers, I am guessing that the number, by total volume passing through wholesale distribution, is still less than 10%. With that as our starting point, and 100% being reached a few years after November 27, 2017, the rest is easy to fill-in.

Just as in previous years, I think the reality has started out near the lower line (red), and at some point in the future it will transition to near the upper line (blue). My theory is, that will happen sometime in mid-2017 as companies start turning on their serial number application systems in greater numbers.

So there it is. Do you think it is accurate? Do you have a different prediction? Leave a comment below.

Dirk.

Believe your analysis is correct, but also believe there will be wide differences between the uptake for specialty pharma and low risk, low cost Rx.